In Texas, borrower defaults on title loans trigger legal actions including repossession and court cases, requiring lenders to verify documents and rights. Consequences include vehicle loss, fees, and high-interest charges but borrowers can negotiate terms or seek alternative financing. Credit restoration after default is feasible through swift loan repayment, budget restructuring, emergency funds, and maintaining other obligations, mitigating FICO score damage over 7-10 years.

“Facing the aftermath of a Texas title loan default? Understanding the required documents and potential implications is crucial. This guide delves into the legal intricacies, financial consequences, and recovery options available to Texans. From gathering essential papers like vehicle titles and loan agreements to navigating potential legal actions, this article provides insights into the steps necessary to mitigate the Texas title loan default consequences. By exploring these aspects, individuals can better comprehend their rights and begin the process of financial recovery.”

- Legal Implications and Documentation Required

- Financial Impact and Recovery Options

- Restoring Credit After Texas Title Loan Default

Legal Implications and Documentation Required

When a borrower defaults on a Texas title loan, several legal implications come into play. Lenders have rights and remedies outlined in state laws to recover the outstanding debt. These may include repossession of collateral, which in this case could be a vehicle, and potential legal action to collect the balance. The borrower might face court orders for repayment or be at risk of losing their asset if they fail to comply with the lender’s demands.

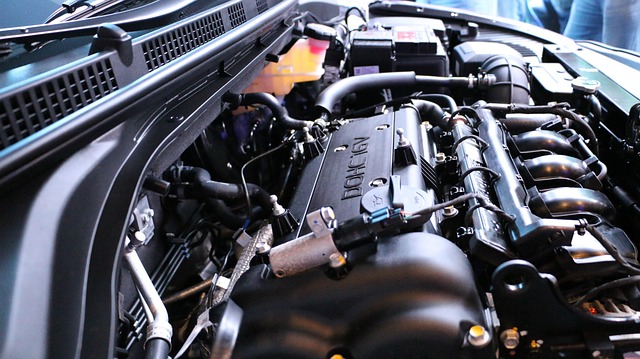

Documentation required after defaulting on a Texas title loan includes proof of identity, loan documentation detailing the terms of the agreement, and records of any attempts made to facilitate repayment. Borrowers should also expect requests for financial information to assess their current financial standing and ability to repay. This process is crucial in ensuring that both parties understand their rights and obligations, especially as it relates to Texas title loan default consequences. Additionally, lenders may require proof of insurance for the vehicle, which was often a condition during the initial loan approval phase, particularly for high-value items like semi truck loans.

Financial Impact and Recovery Options

When you default on a Texas title loan, the financial impact can be significant. Lenders often repossess the secured asset, in this case, your vehicle, leading to loss of transportation and potentially substantial repair costs if the vehicle is returned in poor condition. Legal fees and interest charges can also accumulate, adding to the overall debt burden. However, there are recovery options available for those who find themselves unable to meet the loan terms.

One option is to work directly with the lender to negotiate a repayment plan or modification that fits your financial situation better. In some cases, lenders may agree to “keep your vehicle” arrangements, allowing you to continue using it while repaying the debt over an extended period. Alternatively, exploring Dallas title loans or San Antonio loans from reputable institutions could provide fresh financing opportunities with different terms and conditions designed to help borrowers get back on their feet. Remember, proactive communication with lenders is key to navigating these challenging situations effectively.

Restoring Credit After Texas Title Loan Default

After defaulting on a Texas title loan, restoring your credit score can seem like an insurmountable task. However, it’s not impossible. The first step is to understand the full extent of the Texas title loan default consequences. This includes reporting the default to credit bureaus, which can negatively impact your FICO score for up to 7-10 years. Yet, this period isn’t static; proactive steps can mitigate the damage.

One effective strategy is to focus on paying off the loan as soon as possible, even if it means restructuring your budget. A loan payoff plan, combined with building and maintaining an adequate emergency fund, can demonstrate to lenders that you’re responsible with money. Additionally, keeping up with other financial obligations, such as rent or mortgage payments, will help show creditors that you’re committed to managing your finances responsibly, which can aid in the restoration of your credit score over time.

When facing a default on a Texas title loan, understanding the required documents and potential implications is crucial. This article has outlined the legal documentation needed, the financial impacts, and available recovery options. By knowing these steps, borrowers can navigate the aftermath of defaulting more effectively, aiming to restore their credit standing in time. Remember that proactive measures and seeking professional advice are key to mitigating the Texas title loan default consequences.